Rentvesting is becoming popular as a practical investment option that helps first home buyers begin their journey up the property ladder.

So what does this strategy involve and is it the right choice if you can’t find an affordable home in your area?

What is rentvesting?

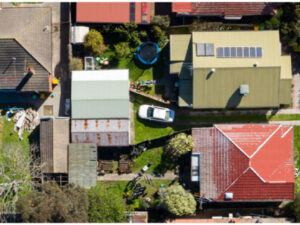

Simply put, rentvesting means you rent a home or apartment that suits your lifestyle while you purchase a property that suits your budget.

For example, if you want to live closer to the CBD but can’t afford to buy a place, you rent a home. You then buy a more affordable property outside the city and rent it out to someone else.

The idea is that your investment grows in value and you can sell it or use the equity you build up to then be able to afford the property you really want.

The pros of rentvesting

This strategy is a simple way to live your preferred lifestyle while building your finances. You get to live in a property and an area that suits you. You don’t have to stay in a more affordable location that doesn’t suit your needs.

Renting also gives you the flexibility to move around and try out new suburbs. You’re not tied down by having to live in the property you own. As a tenant, if something goes wrong with the place you are leasing, it is the owner/property manager’s issue, not yours.

The rental income generated by your investment property can go towards paying off your mortgage (although there is likely to be some shortfall involved). There may even be tax benefits. Investment property expenses are often tax-deductible. Make sure to check with the ATO or your accountant to see what you are eligible for.

The cons

While you have no maintenance worries about the place where you’re living, you are now a landlord yourself. This means you have to deal with maintenance and repairs at your investment property, which can add to the cost of owning it.

You also have the risks that come with renting. If the landlord sells from under you, you might have to live through inspections and spend money to relocate. Rental prices can also go up at intervals and suddenly price you out.

Depending on the market, an investment property always has the potential to lose money. You may find that you have to sell for less than you paid so be very careful when choosing a property as an investment.

If you are a first home buyer, using rentvesting as a strategy may mean you aren’t eligible for a first home buyers grant. Most first home buyer grants require you to live at the property for a set amount of time so you will either have to forfeit the grant or move in for the short term.

Is it worth it?

Deciding whether to rentvest or not comes down to personal choice and circumstances.

Do your research to work out your budget and your lifestyle requirements. Check the details of the first home owner’s grant in your state or territory here, then talk to a mortgage broker and real estate agents to see what your options are. Take your time and look into all avenues before you make any decisions. It may be that rentvesting is the perfect solution to get you into your dream home sooner.

Considering rentvesting as a way to own your first home? Contact the Professionals now to learn more.